Shapiro Croland represents individuals, married couples and small businesses in Chapter 7 bankruptcy filings in the United States Bankruptcy Court for the District of New Jersey.

Shapiro Croland represents individuals, married couples and small businesses in Chapter 7 bankruptcy filings in the United States Bankruptcy Court for the District of New Jersey.

For over 25 years partner Glenn R. Reiser has been helping individuals resolve their financial difficulties and obtain a "fresh start" through the benefits offered by Chapter 7 bankruptcy. When it comes to Chapter 7 bankruptcy cases our law firm primarily serves Northern New Jersey and Central New Jersey where cases are assigned to the Bankruptcy Courts in Newark and Trenton, respectively.

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy is considered a liquidation proceeding best suited for individuals with substantial debts and assets of limited value. Because federal bankruptcy law limits the amount of assets that individuals can exempt from the reach of creditors, the decision on whether to file a Chapter 7 bankruptcy case is one that should only be made by consulting with experienced bankruptcy counsel.

The filing of a Chapter 7 bankruptcy case results in the appointment of a trustee. The trustee's role is to administer your bankruptcy case and determine whether any assets are available above and beyond the exempted amounts permitted under the U.S. Bankruptcy Code. Most of the Chapter 7 cases handled by LoFaro & Reiser are "no asset" cases, meaning that the debtor's assets are completely exempted from the reach of the trustee and creditors.

We carefully evaluate each client's financial situation to determine whether Chapter 7 bankruptcy is the right decision. In the rare occasion where a bankruptcy trustee determines there are assets to be liquidated, the trustee sells the assets and pays the debtor any amount exempted. The net proceeds of the liquidation are then distributed to creditors with a commission taken by the trustee overseeing the distribution.

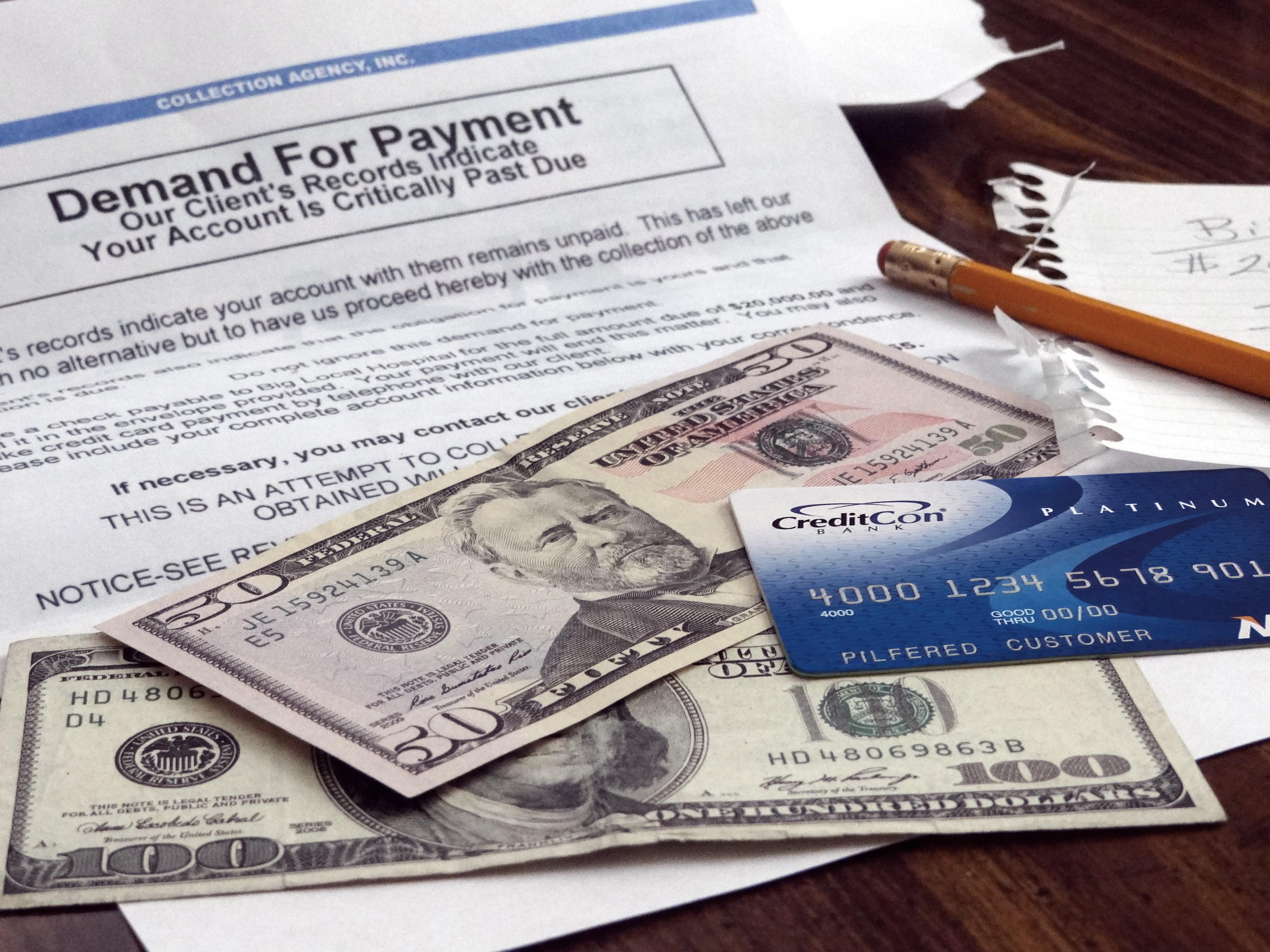

Does Chapter 7 bankruptcy stop collection lawsuits and creditor harassment?

Yes. The filing of a Chapter 7 bankruptcy case creates an automatic stay under the U.S. Bankruptcy Code which prohibits creditors for continuing with collection lawsuits, enforcing judgments, sending collection letters or making harassing phone calls.

Do I have to appear in Court to testify?

Yes. In Chapter 7 bankruptcy cases the court appointed trustee will examine you under oath at a meeting of creditors that is scheduled by the Bankruptcy Court Clerk. The bankruptcy judge is not present at this meeting. The debtor and bankruptcy counsel will attend the meeting, at which time the trustee will ask for proof of your identity and question you about your assets and liabilities.

Can I walk away from every debt in a Chapter 7 bankruptcy filing?

Certain debts cannot be discharged in a Chapter 7 bankruptcy, such as alimony, child support, fraudulent debts, certain taxes, student loans, and certain items charged. In the typical Chapter 7 cases, the debtor has large credit card debt and other unsecured bills and very few assets. In the vast majority of cases a Chapter 7 bankruptcy is able to completely eliminate all of these debts.

What about my car and house?

Chapter 7 debtors may retain certain property secured by liens such as a car and home. In a Chapter 7 case the debtor is obligated to provide an appraisal for any real estate owned by the debtor. If your property has no equity or minimal equity that does not exceed the amount of the federal homestead exemption the bankruptcy trustee will "abandon" any claim against your home. However, to retain your home you will need to stay current on your mortgage payments and real estate taxes.

When it comes to retaining cars secured by a lease or financing agreement a Chapter 7 debtor is required to sign a contract that reaffirms the debtor's promise to pay the pre-petition lease or loan agreement. Known as a "Reaffirmation Agreement", if you elect to keep the car you cannot bankrupt (or wipe-out) that debt again for eight years. You will still owe that debt and you must continue to pay it just as you were obligated to continue to pay it as if no bankruptcy case were ever filed.

Why hire Shapiro Croland as your Chapter 7 bankruptcy counsel?

Our attorneys are experienced bankruptcy practitioners who know the "ins" and "outs" of Chapter 7 cases. Our attorneys' litigation experience and knowledge of bankruptcy law enables our law firm to be an effective advocate for clients facing the pressures of debt collectors, aggressive creditors and bankruptcy trustees.

Contact our New Jersey bankruptcy lawyers today to find out whether Chapter 7 is appropriate for you.